M&A activity in 2021 is on track to beat the historical records in 2021, with 748 deals over $100 million closed in the period.

The main question that comes to mind is "why is that"? Let's start by understanding the reasons companies go through an M&A in the first place.

Companies acquire (or merge with) other companies to accelerate growth which is usually a strategy for survival in a highly competitive market. Only competition creates enough pressure to grow faster than you could organically. Whatever the scenario, the intention of the deal is to increase the size or strength of the surviving company.

But competition standalone does not guarantee that M&A activity will thrive. Acquisitions require large pockets, coming from either the buyer or from players in the ecosystem willing to fund these acquisitions. In either case, you need to have experience and a track record to prove that you, as a buyer, will be able to provide the returns that investors are expecting for the deal being financed.

So the combination of these two factors (highly competitive market and mature ecosystem) can be put as the main reasons for such a hot M&A market in 2021. If you add liquidity abundance with low-interest rates and a lot of companies that struggled to survive during the pandemic (becoming cheaper targets) you have the perfect recipe for consolidation of the market.

M&A in public companies has always been the rule, the most interesting trend is the uptake in the so-called 'micro' space. Thanks to digital acceleration during the pandemic, startups, and smaller businesses are competing on a global scale now more than ever.

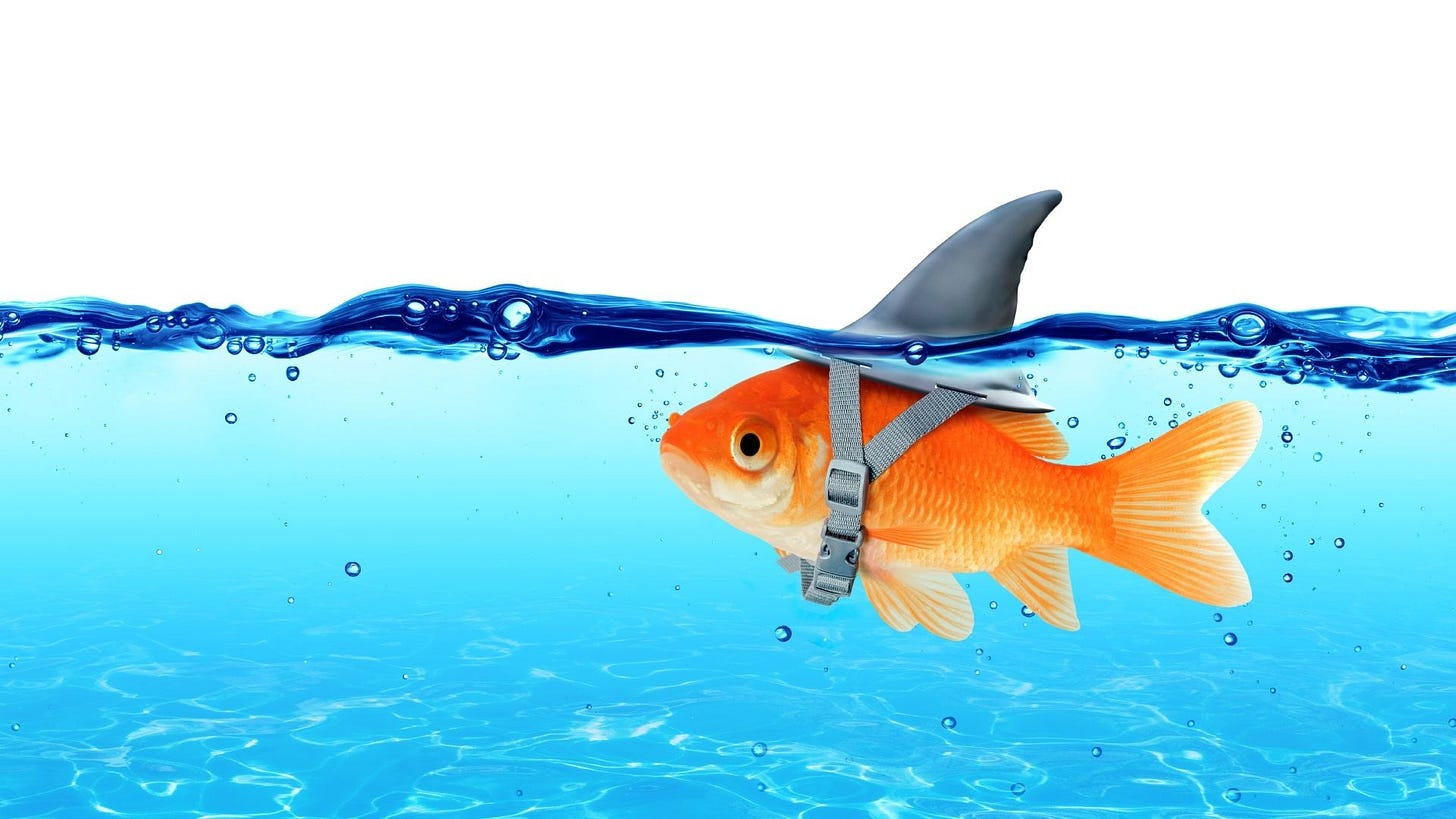

The ecosystem to support the consolidation activity in this space is also catching up. With investors willing to finance acquisitions, and platforms such as MicroAcquire, Tiny, and Flippa streamlining the M&A process (due diligence, documentation, and actual deal closing) and aggregating the information on sellers in the startups and SMBs segment, the buy-to-grow strategy is becoming even more democratic and available for the 'small fishes'.

With a growing trend of ‘democratization of venture capital, there is more availability of outsiders’ capital to be available to finance acquisitions for SMBs and Startups. My husband’s company Outsource Accelerator, for example, just raised $1.5 million with Capchase to exclusively finance website acquisitions.

We are definitively living in exciting times of competition, M&A ecosystem development, and opportunities for smaller companies to have access to capital to boost their growth and thrive.

🎧 Podcast recommendations

▶️ The journal by WSJ - How ‘Squid Game became a Megahit’: I’m fascinated by the entertainment industry and how there’s always a formula behind any ‘viral’ content. Squid Game is the new viral series from Netflix and understanding the reasons behind it is quite enlightening on human behavior. Worth a listen at the history behind it.

▶️ Planet Money: We set up an offshore company in a tax haven (Classic): Very interesting podcast to understand the costs and benefits of countries in which the whole economy revolves around entities incorporation in tax haven locations.

This is Open Books - a weekly newsletter carefully curated by me, Leticia Souza. Every week I’ll be compiling relevant topics around finance and financial strategy - from choosing your first accounting system to how to successfully close a fundraising round to your business.

In a world full of noise, I aim to bring clarity and direction to your finance processes so you can manage your business in peace. If you find the content useful, do your friends a favor, and please share this newsletter with them.

See you all next week 👋🏼

Leticia

Great newsletter!